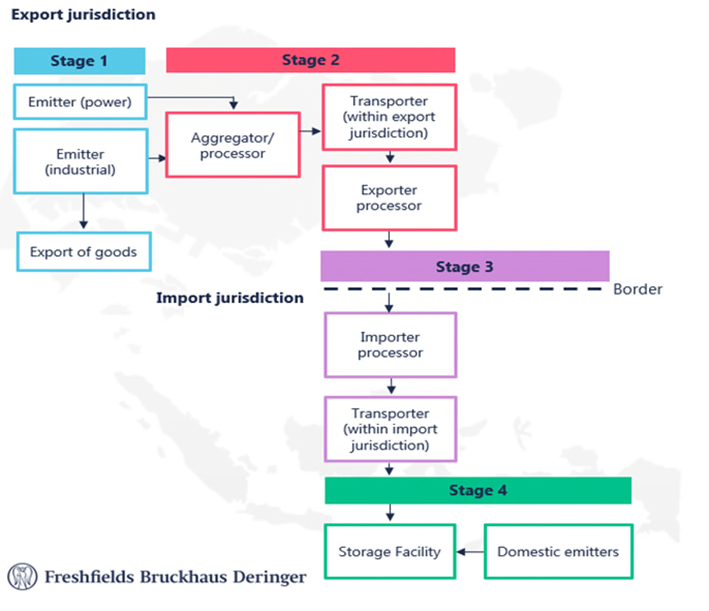

In Part 1 of this three-part blog series (see part 1 here), we introduced the concept of a cross-border carbon capture, use and storage (CCUS) project where CO2 generated in one jurisdiction (the Export Jurisdiction) is collected and transported for permanent storage in another (the Import Jurisdiction). In this Part 2 we consider:

- what economic and political incentives may need to be in place for stakeholders to participate in a CCUS project, which will influence the overall design of the project (see stage 1 of the diagram below); and

- what issues are likely to arise when collecting and transporting the CO2 within the Export Jurisdiction, up to the international border (see stage 2 of the diagram below).

Stage 1 – Incentivisation for engaging in CCUS activities: CO2 emitters in the Export Jurisdiction will need to be sufficiently incentivised to engage in, and pay for, CCUS activities. The nature of these incentives will ultimately influence the design of the cross-border project across the full transport and storage value chain. Such incentivisation may arise: (i) directly, from emitters’ participation in CO2-intensive or CCUS activities within the Export Jurisdiction (in particular carbon pricing / taxation, but also tax reliefs such as preferential treatment capital allowance on CCUS infrastructure, or subsidies for CCUS activities); and (ii) indirectly, from economic consequences which result from the onward sale and export of products generated from CO2-intensive activities. These factors are considered further below.

Carbon pricing: The carbon pricing regime in the Export Jurisdiction will play a material role in the economic viability and design of the project. If the cost to the emitters of participating in the CCUS project will be less than the applicable carbon pricing burden (also taking into account any other available incentives), this may motivate emitters to join the CCUS process and influence the design of the project (e.g. selecting an Export Jurisdiction with favourable carbon pricing allowances).

For instance, where the chosen Export Jurisdiction is in the EU, the EU Emissions Trading Scheme (EU ETS), a ‘cap and trade’ approach to carbon pricing, will apply. Under the EU ETS, emitters are permitted to emit a certain amount of CO2 per year, with each tonne of emitted CO2 equivalent to one tradeable emissions allowance. To avoid facing financial and civil penalties, emitters likely to emit more than their allocated yearly allowance will either need to reduce their emissions (e.g. via CCUS activities (as emitters in Europe are not required to surrender emissions allowances in respect of CO2 that is permanently stored in a CCUS facility in Europe)) or purchase additional allowances. Notably even non-EU-based emitters may be affected by the consequences of the EU ETS (see ‘Onward sale of products’ below). A provisional agreement reached by European co-legislators in December 2022, due to become law in the coming months, will set even higher emission reduction targets on industries under EU ETS by 2030. This will likely provide more opportunities for CCUS, to help European industries meet the new targets (a 62% emissions reduction target in EU ETS sectors by 2030). Separately, a large number of jurisdictions (such as Singapore and Norway) regulate carbon emissions via a carbon tax (a tax typically levied on an emitter’s, per tonne, yearly greenhouse gas emissions).

With both emissions trading schemes and carbon taxes, relief may be available to protect key industries which are carbon-intensive and particularly exposed (including as a result of international competition) to the economic impacts of carbon pricing (e.g. the Singaporean government is currently consulting with industry on the design of a framework to grant tax allowances to certain emitters, where emitters can evidence (to-be-determined) carbon efficiency standards and decarbonisation targets (source)). Whether or not carbon pricing reliefs remain available once CCUS activities become viable will be a significant determinant of whether emitters are exposed to the marginal impact of carbon pricing, which will in turn affect their motivation to participate in CCUS activities.

Onward sale of products: Parties may also be incentivised to engage in CCUS activities indirectly by the consequences of the onward use or sale of products/outputs. Certain of these products/outputs (e.g. steel) (Generated Products) generate CO2 as a by-product. The term commonly used to describe the CO2 output inherent in such products is “embedded CO2”. Onward use and export of Generated Products may be subject to regulatory or economic consequences, contingent upon the associated levels of embedded CO2. For instance, non-EU importers (which may not necessarily be the emitters in the Export Jurisdiction) intending to export certain Generated Products to the EU will be subject to the Carbon Border Adjustment Mechanism (CBAM). CBAM will subject importers to a carbon pricing burden comparable to the carbon price borne by EU domestic producers under the EU ETS regime. In some cases, the capture and storage of embedded CO2 may provide relief from these consequences (analogous to the position whereby European emitters are not required to surrender EU ETS allowances where CO2 is permanently stored in a CCUS facility in Europe). However, it is not yet clear if the CBAM liability of non-EU entities importing Generated Products into the EU would benefit from this relief if the embedded CO2 is stored outside the EU.

The EU reached a provisional agreement on CBAM in December 2022 and the final adoption of CBAM is expected to take place in Spring 2023. We expect CBAM to enter into force in transitional form from 1 October this year, gradually implemented from 1 January 2026 and fully operational by 2034. For further discussion of CBAM, please see our blog here.

Low carbon standards: We are seeing increasing interest from regulators in providing a clear framework for applying low carbon standards to an ever-broader range of products e.g. the UK Low Carbon Hydrogen Standard which sets a maximum threshold for the embedded carbon allowed in the production process for hydrogen to be considered ‘low carbon hydrogen’. Where such standards are not met, emitters may be unable to benefit from governmental support and/or from premia to be paid by consumers for such products. In addition, customers placing increasing importance on a sustainable supply chain may require low levels of embedded CO2, even if there is no regulatory impact associated with such attributes. To achieve the premium prices associated with sustainably produced products, consideration will need to be given to investing in verifiable sustainability measures to differentiate products on global markets (e.g. by using captured CO2 techniques or utilising clean technologies as part of the project’s design).

For the reasons described above, it will be important to consider the economic motivations for the various stakeholders to support CCUS activities at the early project-design stage, so that the entire value chain can be set up to ensure the project’s economic viability. However, we note that a project may also be pursued in part to comply with corporate commitments to reduce carbon emissions. Accordingly, emitters, and other private stakeholders in the project, may have reasons to pursue the project even if economics alone are insufficient to justify participation.

Stage 2 – Processing and transportation of CO2 to the country border

Once the economic feasibility of the project has been established, careful consideration will need to be given as to how CO2 from emitters’ facilities will be processed and transported through the Export Jurisdiction to the international border (the Transport Process). In particular, the project participants will need to determine who will be responsible for operation and ownership of the Transport Process infrastructure, and how liability will be apportioned, across each element of the Transport Process.

Responsibility and roles: There will be a number of separate and distinct roles for one or more entities throughout the Transport Process. For example: (i) an aggregator facility operator (who may receive and aggregate CO2 from multiple emitters in the Export Jurisdiction); (ii) the operators of the transport network infrastructure (which may be by ship and/or pipeline, depending on geography and project-design); and (iii) the operator of the CO2 storage facility in the Import Jurisdiction (this storage role, and associated considerations, will be discussed in more detail in Part 3 of this series).

These functions could be performed by different entities or by one entity across the whole transport and storage chain. In addition, these roles could be performed by the private sector (via an independent business model, as anticipated under the UK’s ‘Transport and Storage Regulatory Investment (TRI)’ model, under ongoing development), public sector (public infrastructure) or a mixture of both (e.g. the arrangement could follow a similar model to Singapore’s LNG terminal at Jurong Island, where LNG is aggregated, imported and processed for storage, with development and operational activities overseen by a government-linked company, ‘Singapore LNG’). The project sponsors will need to determine the preferred structure for the ownership and operation of the project and to what extent governmental involvement would be beneficial (e.g. to assist in providing permits, access to land and assistance in accelerating regulatory development to enable the project), or otherwise will be stipulated by that government.

Risk-sharing arrangements: Regardless of who performs the roles involved in the Transport Process, risk will have to be apportioned appropriately between the various roles, including the relevant governments (if they are willing to assume part of this risk, which may be required to make the project commercially viable and bankable). We set out below key areas of risk which would likely need to be negotiated via contractual arrangements and facilitated via discussions with the applicable governments, at the early project-design phase:

- Planning and permitting: where planning and permitting for the Transport Process infrastructure is not obtained in time, issues may arise as to which party will bear the costs and other consequences of the potential delay (or outage) of the infrastructure, particularly if this has knock-on effects on emitters’ supply chains. These issues warrant early discussions with relevant governments to ensure that any required support is obtained. If it becomes apparent that there will be gaps in risk allocation, these will need to be contractually allocated. Particular consideration should be given to change in law risk, which project sponsors would ideally want to be borne by the relevant government (which will have ultimate control over changes in local legislation). This will protect emitters from future amendments to legislation which may otherwise result in non-compliance with planning and permitting requirements.

- Construction risk: while a full project development assessment will be required, particular consideration will need to be given to: (i) sectional interface risk (i.e. where different entities are responsible for constructing different parts of the Transport Process infrastructure, a contractual regime will need to be in place to address due dates for completion and operational deliverables for each part of the infrastructure); (ii) compatibility interface risk (i.e. where operational assets connect to, or operate alongside, the Transport Process infrastructure, to ensure assets are compatible, including that applicable technical specifications meet local requirements and regulations); and (iii) delayed construction risk (i.e. how, and by whom, impacted parties will be compensated if the overall construction of the Transport Process infrastructure is delayed. For example, the pipeline owner in the Import Jurisdiction may expect to receive a capacity fee for a pre-agreed term which will begin to erode if the project’s envisaged start date is not achieved).

- Ongoing operation and maintenance outages: once the Transport Process infrastructure is operational, risks may arise around its ongoing maintenance and operation, including routine maintenance, temporary outages and permanent cessation of part of the value chain. Contractual arrangements will need to address, in each case, what relief may be available to the affected parties and with whom liability for each such outage should lie.

- Intellectual property: the separation and transport of CO2 may in some cases require access to proprietary technology and processes, for example if specially designed chemical solutions are used to separate CO2 from by-products and keep it in an appropriate form for transport. Various entities along the Transport Process chain may require access to this technology (e.g. via a licence) in order to perform their roles.

***

In Part 3 of this series, we will analyse the issues associated with CO2 crossing an international border and its eventual storage in an Import Jurisdiction. In particular, we will consider how governments in the Export and Import Jurisdictions could cooperate in order to appropriately allocate risks and the legal challenges resulting from the multi-jurisdictional nature of a cross-border project (e.g. conflicting regulations and requirements across jurisdictions, how allocation of liability for leakage of CO2 could be apportioned across governments, customs and tariff considerations, and challenges associated with the characterisation of CO2 as a waste product across differing international and local regimes).

If any of the topics in this series are of interest to you, please do not hesitate to reach out to us for further discussion; our global experience in CCUS projects means we are well placed to advise you on any part of the CCUS value chain.

/Passle/581a17a93d947604e43db2f0/MediaLibrary/Images/2025-07-07-12-19-36-690-686bbb58a2144a0551f2166e.jpg)

/Passle/581a17a93d947604e43db2f0/MediaLibrary/Images/2025-06-26-07-36-45-942-685cf88d527dd493930422da.jpg)