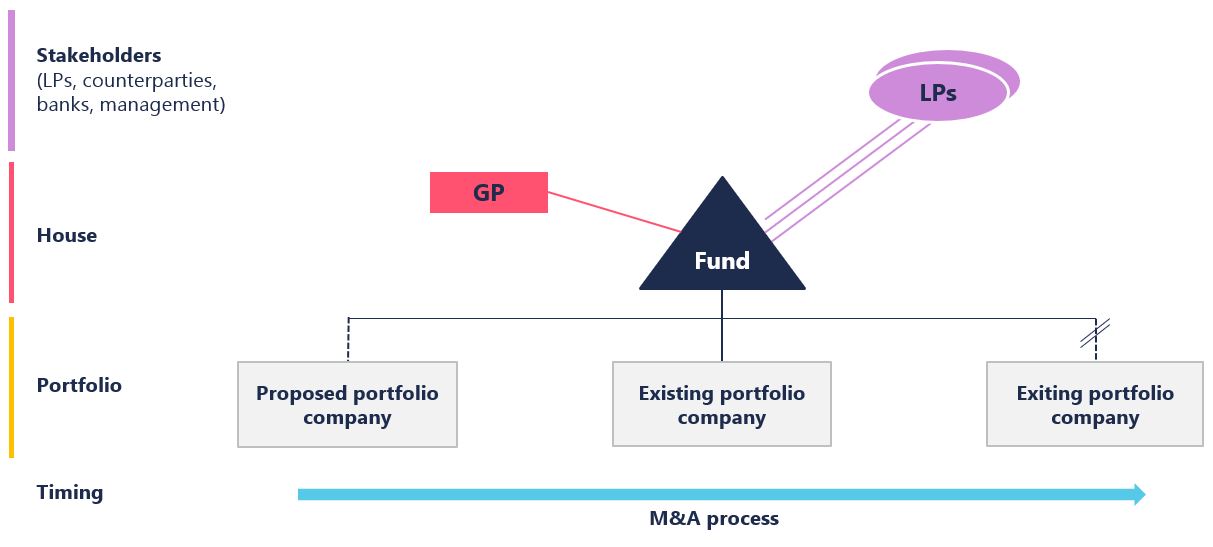

Financial sponsors are faced with a broad waterfront when it comes to managing ESG legal risk. The need to evaluate these wide-ranging ESG matters presents significant business and legal challenges for financial sponsors at the stakeholder, house and portfolio levels across diverse geographies and industries. At the same time, ESG presents opportunities for sponsors to differentiate themselves in increasingly competitive private capital markets. Below we have set out some of our key client takeaways and priorities in this area.

Fig 1. Financial sponsor ESG waterfront: risks from stakeholders, as a house, in the portfolio, and in the M&A life cycle

M&A – enhanced diligence on whole ecosystem – a basis for competitive advantage and a positive ESG story

Value creation. In M&A processes, we see sponsor clients increasingly turning to us for more sophisticated ESG issues, to help them identify ESG value creation opportunities as well as ESG risks. This often means integrating our legal output with that of specialist practitioners (both external and internal). Sponsors can gain a significant competitive advantage in auction processes and in reverse diligence from corporate sellers. This angle can also bolster their ability to deliver and execute transactions with complex ESG dynamics.

Shift to ecosystem diligence. Properly incorporating ESG into the diligence process requires a shift from focusing solely on the target to focusing on the target’s whole ecosystem, including its suppliers, social issues, political environment and governance processes (i.e. encompassing the “S” and the “G” risks, as well as the “E”). ESG diligence cannot be limited to a check-the-box compliance exercise but must be integral to the strategic approach to all transaction deal terms.

Investment Committee focus. The ESG profile of target businesses increasingly sits at the heart of investment hypotheses. Investment committees are focussing more and more on ESG matters and will often require enhanced or fast-tracked diligence on ESG hotspots and detailed assessments on how ESG fits into post-deal value creation plans and exit stories. The need for sponsors to develop ESG narratives earlier in their investment process is key for outpacing competitors to desired targets.

The regulatory landscape – towards hard obligations and standardisation

Reporting, disclosure and beyond. The most visible trend in the ESG regulatory and policy arena is the move towards standardising the numerous ESG disclosure and reporting standards. We expect this trend will continue to impact financial sponsors. We are also seeing the proliferation of disclosure regulations in recent years begin to transition to substantive obligations around diligence and sustainability, with a movement towards mandatory reporting standards capable of objective valuation and subject to audit. Ensuring that both the house and portfolio reporting mechanisms are compatible with new standards will be a clear priority for sponsors, as will meeting their substantive regulatory obligations and managing their public ESG profile.

Looking ahead to heightened regulation. Some jurisdictions are pressing to lead the field in terms of regulation – the prime examples being TCFD in the UK and the EU Taxonomy, with the US following with SEC proposals on climate-related disclosure obligations and investment advisers’ ESG strategies. Other jurisdictions are looking to follow suit and use those regimes as their starting points. While climate regulations are the most developed currently, the next areas of focus topics is already surfacing, including those related to human rights and the use of natural resources. Sponsors can expect their portfolio companies to be subject to a range of incoming regulations and should ensure that regulatory horizon-scanning forms part of their investment decision-making.

Disputes and Investigations – novel claims and greater appetite to bring them

Hardening of legal obligations. ESG litigation and enforcement risk remains a key focus area. Investors and portfolio companies have been the subject of claims from stakeholders, other civil counterparties and NGOs, as well as prosecutions and investigations by regulators and enforcement agencies. The proliferation of laws in these areas (for example relating to climate impact and human rights) are imposing more and more obligations. We have now seen the first, but certainly not the last, dawn raids on companies accused of greenwashing, thereby misleading their investors. Claims of this nature have the potential for significant impact on the value of the portfolio company.

Extended obligations to parent companies. Claimants and courts have brought, in recent years, novel claims which seek to demonstrate areas in which parent companies are liable for the actions of their subsidiaries, connected with ESG issues. This is particularly relevant where a UK or US-based parent company has operations (say, mining, oil) that are run through subsidiaries in other jurisdictions. Sponsors should be rigorous in ensuring that the information contained in their public statements, reports and marketing materials (and those of their portfolio companies) are all accurate and consistent. Given the backdrop of increasing legal obligations and focus on greenwashing, policies and statements that are not sustained or substantiated in practice can lead to significant risk at all shareholding levels. To help mitigate any potential parental liability, sponsors should ensure that ESG policies are fully risk-assessed at portfolio level, and that they are aligned with their portfolio companies on reporting, information sharing and the ways in which ESG decisions are taken and documented.

Stakeholders – building a competitive edge with LPs, talent, management, financiers, competitors

Financial sponsors are competing to demonstrate ESG competence, credentials and leadership to their stakeholders (LPs, talent, financiers, management teams). Currently, practices and levels of engagement vary, but we expect sponsors to focus increasingly on compliance with standardised reporting, driving the ESG story of their portfolios, and proactively engaging with their stakeholders on the ESG strategy of their firm. Making progress on the priorities outlined above will no doubt lead to a higher level of engagement and collaboration with stakeholders on ESG matters.

Fig 2. Trends in key legal risk areas for financial sponsors

For more information on our thinking on ESG risks and opportunities, please see our other recent posts shown below.

/Passle/581a17a93d947604e43db2f0/MediaLibrary/Images/2025-07-07-12-19-36-690-686bbb58a2144a0551f2166e.jpg)

/Passle/581a17a93d947604e43db2f0/MediaLibrary/Images/2025-06-26-07-36-45-942-685cf88d527dd493930422da.jpg)