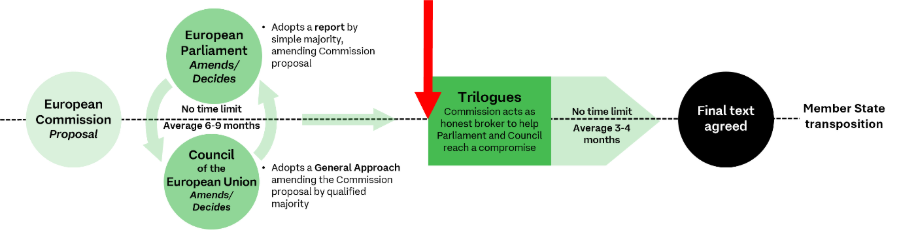

The European Parliament (EP) has agreed its position on the sustainability Omnibus 1, paving the way for the last phase of the legislative process to start: negotiations between the EP, Council and Commission, called “trilogues”, on the final form of the revised CSRD, CSDDD and Taxonomy Regulation.

Negotiations to get to this point have been particularly tense, with the largest political group, the centre-right (EPP), negotiating possible deals either with its usual centrist coalition partners or with the far-right. In October, a first trilogue mandate adopted by the Legal Affairs Committee (JURI) failed to gather enough support. On 13 November, the EP plenary eventually endorsed a final position supported by the EPP with support of right-wing parties.

Our blog highlights the EP’s position on key Omnibus provisions, and explains the steps that will now follow, as the EP, Council and Commission aim to reach agreement on the final wording of the three laws. (see our previous blogs on the Commission’s proposal here and the Council’s general approach here).

EP’s position on key changes to CSRD

The EP’s proposal would further reduce the number of companies required to report under CSRD and make reporting obligations less onerous.

To this end, the EP proposes to raise the applicability thresholds for EU companies: For FY 2027 reporting (also known as Wave 2), only EU companies with more than 1,750 employees and who generate more than €450m in net turnover (individually or aggregated with their subsidiaries) would be required to report. This is a significant uplift to thresholds in the current CSRD and also in the Council’s general approach, as it currently stands.

For non-EU headquartered groups reporting from FY 2028 (also known as Wave 4), who will report under the narrower non-EU sustainability reporting standards or “NESRSs” (for which the delayed Commission deadline for adoption is October 2027), the EP agrees with the Council that there should be no employee threshold. However, the EP’s wording would mandate reporting if any EU subsidiary or branch generates a net turnover exceeding €450m (noting that there is ambiguity as to whether this is “on a consolidated basis” in the current drafting).

This means that, if the EP’s proposal is adopted:

It appears that Wave 4 global group reporting will be required in respect of the groups of all Wave 2 companies which have a non-EU parent (although it is unclear whether the Wave 4 net turnover threshold is applied on a “consolidated basis” in the same way as the net turnover threshold for Wave 2); but

Wave 4 could also apply to groups with no Wave 2 companies, where they include EU companies which are over the €450m net turnover threshold, but under the 1,750 employee threshold.

In addition, the EP’s position also introduces changes designed to assist companies to comply with CSRD reporting obligations:

Exemption for financial holding companies in Wave 2: EU financial holding companies in Wave 2 would be fully exempted from CSRD reporting obligations.

Deferred reporting for recent acquisitions: Wave 2 Companies would have a two-year grace period to integrate information on newly acquired subsidiaries into their report.

Stricter limits on value chain information or ‘value chain cap’: To reduce the burden on smaller companies, reporting entities would be prevented from requesting information from suppliers or customers in their value chains who do not exceed an average of 1,750 employees and €450m net turnover, unless that information is within the scope of the new EU voluntary sustainability reporting standard for small and medium-sized undertakings.

Interoperability to be embedded in reporting standards: The EP’s position requires the sustainability reporting standards to “ensure to the greatest extent possible interoperability with internationally recognized standards”. This nod to the ISSB standards (or similar) could help companies with global operating footprints to more readily meet sustainability reporting obligations across borders.

Restrictions on sensitive information: While narrower than the Council’s general approach, the EP’s position on non-disclosure of sensitive information would still provide exemptions for information on intellectual capital, IP, know-how, business information and technological information which constitute trade secrets.

Comply or explain: Where complete information regarding an undertaking’s value chain is not available, incomplete or legally restricted, undertakings should provide an explanation as to the efforts made, why the information could not be obtained and the plans to obtain it in the future.

Limited assurance requirement: The EP supports both the Commission’s and the Council’s approach to remove the option of increasing the CSRD assurance standard from limited to reasonable.

Key changes proposed for CSDDD

On several key issues, the EP’s position deviates from the Commission’s proposal and the Council’s general approach. Most notably, the EP proposes the adoption of a risk-based approach to due diligence, stricter limits on information requests from business partners and the complete removal of the climate transition plan obligation.

The key changes are:

Increased applicability thresholds: In line with the Council’s general approach, the EP’s position would significantly raise the relevant employee threshold from 1,000 to 5,000, and the relevant net turnover threshold from €450m to €1.5b. Notably, no changes to the existing CSDDD rules for franchising and licensing scenarios are proposed, meaning companies that generate over €80m in EU turnover and more than €22.5m in EU royalties would remain within scope.

Eliminating the climate transition plan obligation: As the most far-reaching amendment, the EP proposes to delete obligations regarding climate transition plans in their entirety. Companies would no longer be required to adopt nor put into effect a transition plan for climate change mitigation. The recital explains that these provisions were deemed disproportionate, particularly due to the administrative burden on companies and competent authorities, and had the potential for legal uncertainty. The retention or removal of the climate transition plan obligation was a highly contentious issue during negotiations, and is expected to remain a key point of debate in the upcoming trilogue negotiations.

Risk-based approach to due diligence: While the EP’s position would retain the concept of a two-step risk analysis, it would not differentiate obligations across supply chain tiers, and instead mandate an entirely risk-based approach to due diligence, marking a significant departure from both the Commission's proposal and the Council’s general approach:

Companies would be required to conduct a scoping (previously “mapping”) exercise based solely on “reasonably available information”. In response to stakeholder feedback, the EP explicitly defines this as “information which can be obtained by the company from its own, or from existing or secondary sources, without contacting a business partner”.

Companies would only be required to carry out “further assessment” where, based on “relevant and verifiable information”, a company has grounds to believe that adverse impacts have arisen or may arise and where they were identified to be most likely to occur and to be most severe; against this background direct business partners could be prioritized. Companies would not be required to request any information from business partners where no such likely and severe risks were identified.

The EP emphasizes that companies should be granted significant flexibility in prioritizing which risks to address first on the basis of the severity and likelihood of an adverse impact. This assessment should consider the scale, scope, or irremediable nature of the impact, as well as its overall gravity. Only once the most severe and likely adverse impacts are addressed, are companies required to turn to less severe and less likely adverse impacts. Importantly, the EP clarifies that companies should not be penalised for harm arising from less significant adverse impacts that have not yet addressed in line with the risk-based approach.

Restrictions on information requests or ‘value chain cap’: To mitigate the “trickle-down” effect on smaller business partners, the EP’s position would restrict companies from requesting information from business partners with fewer than 5,000 employees except in “last resort” cases, where that information cannot reasonably be obtained by other means. This represents a significant increase compared to the 1,000-employee threshold proposed by the Council.

The EP’s position would protect a company from penalties where it takes appropriate steps to identify adverse impacts but lacks access to all the information on its chain of activities that would be necessary to prevent, mitigate, end or minimize an adverse impact. This protection would only apply where a company reasonably explains why the information could not be obtained.

Replacing the “duty to terminate” business relationships: The EP’s position would replace the “duty to terminate” business relationships (as a last resort measure) with a “duty to temporarily suspend” the relationship, unless the suspension would cause “substantial prejudice” to the company. The proposed recitals clarify that this would apply to scenarios where suspension would have “a negative and significant effect on the company’s legal, financial or economic situation or its production capacity, including in the long term, such as an effect giving rise to the likelihood of insolvency”.

In line with the Council’s general approach, the EP’s position clarifies that continuing engagement with a business partner (despite actual or potential adverse impacts) does not expose the companies within scope to penalties or civil liability, if there is reasonable expectation that the enhanced prevention / correction action plan will succeed.

Adjusting pecuniary penalties: In line with the Council’s general approach, the EP proposal asks Member States to set the fixed maximum limit for pecuniary penalties at 5% of the (consolidated) net worldwide turnover of the relevant company.

Removing harmonized EU-wide civil liability: In alignment with the Commission’s proposal and the Council’s general approach, the EP’s position would also remove the EU-wide civil liability regime (see our previous blogpost here) in favour of national liability regimes, and exclude representative action by NGOs and trade unions, while requiring member states to ensure an effective access to justice and effective remedy through provisions on full compensation, limitation and disclosure.

Next steps

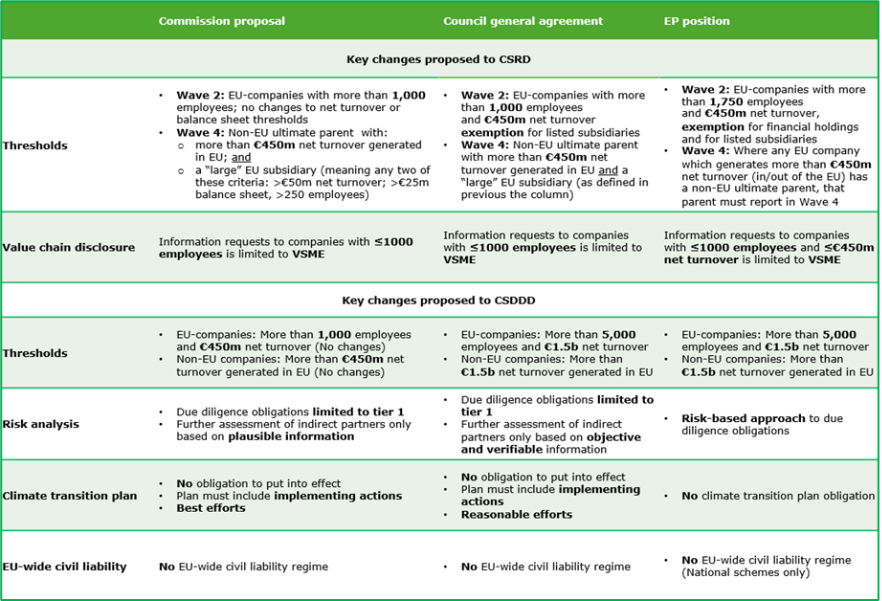

The positions of the three institutions are relatively aligned, save for some isolated but important issues, such as the thresholds for CSRD reporting by non-EU-headquartered corporate groups, and the treatment of climate transition plans. This is illustrated by the table below. The EU institutions continue to aim for an agreement on the final provisions of the revised Taxonomy Regulation, CSRD and CSDDD by the end of the year possibly on 8 December.

The first trilogue meeting takes place on 18 November with the relevant institutional representatives with the objective to ensure a speedy negotiation process. Given that trilogue negotiations are not public,it is crucial to stay very close to the process. We also expect geopolitical considerations, especially political pressure coming from certain third countries, to possibly play a role in the trilogue negotiations. Freshfields will continue to monitor the situation to assess the likely landing spot of the legislative revisions and their implications for companies’ compliance strategies.

/Passle/581a17a93d947604e43db2f0/MediaLibrary/Images/2025-09-03-13-51-25-956-68b847dd1d680d7ad1a1eb32.jfif)

/Passle/581a17a93d947604e43db2f0/MediaLibrary/Images/2025-09-17-09-53-38-972-68ca85228206a7b6398617e6.jpg)

/Passle/581a17a93d947604e43db2f0/MediaLibrary/Images/2025-07-07-12-19-36-690-686bbb58a2144a0551f2166e.jpg)